Creating a Legacy

Would you like to make a gift of cash or securities to ASHRAE Foundation while retaining needed income for yourself and your loved ones? ASHRAE Foundation offers gift-planning services to all ASHRAE members and can help you create a gift annuity contract to support the work of ASHRAE.

Would you like to make a gift of cash or securities to ASHRAE Foundation while retaining needed income for yourself and your loved ones? ASHRAE Foundation offers gift-planning services to all ASHRAE members and can help you create a gift annuity contract to support the work of ASHRAE.

Increase Your Income and Make a Gift to ASHRAE

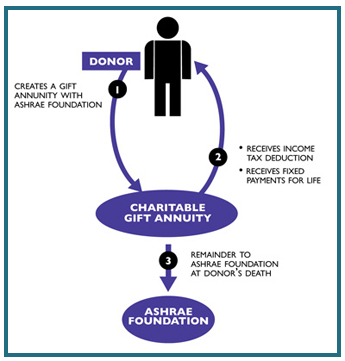

Gift annuities are rewarding and simple to arrange. You make an irrevocable contribution of cash or securities and may claim a one-time charitable deduction for part of your gift. In exchange, you will receive quarterly payments for life, guaranteed. One or two people-you and your spouse, for example-may be named as income recipients. Payments are fixed and the amount of your payment depends on the ages of the annuitants. When you die, the balance of your gift principal is distributed to support the work of the ASHRAE Foundation.

Use Appreciated Property to Increase your Benefits

Gift annuities are a great way to give appreciated securities because part or all of the capital gains tax may be excused, and the remainder distributed over a period determined by life expectancy. You may be able to generate a larger income stream from low-yielding assets, and you will create a wonderful legacy for ASHRAE Foundation.

What will your payments be?

You can visit the ASHRAE Foundation web site to compute your benefits using our online calculator. http://foundation.ashrae.biz/gift.html

We can provide a personalized example of how a gift annuity could work in your particular situation. Contact Margaret Smith at ASHRAE Foundation via email at msmith@ashrae.org or by calling 678-539-1201.

|